New year brings new challenges

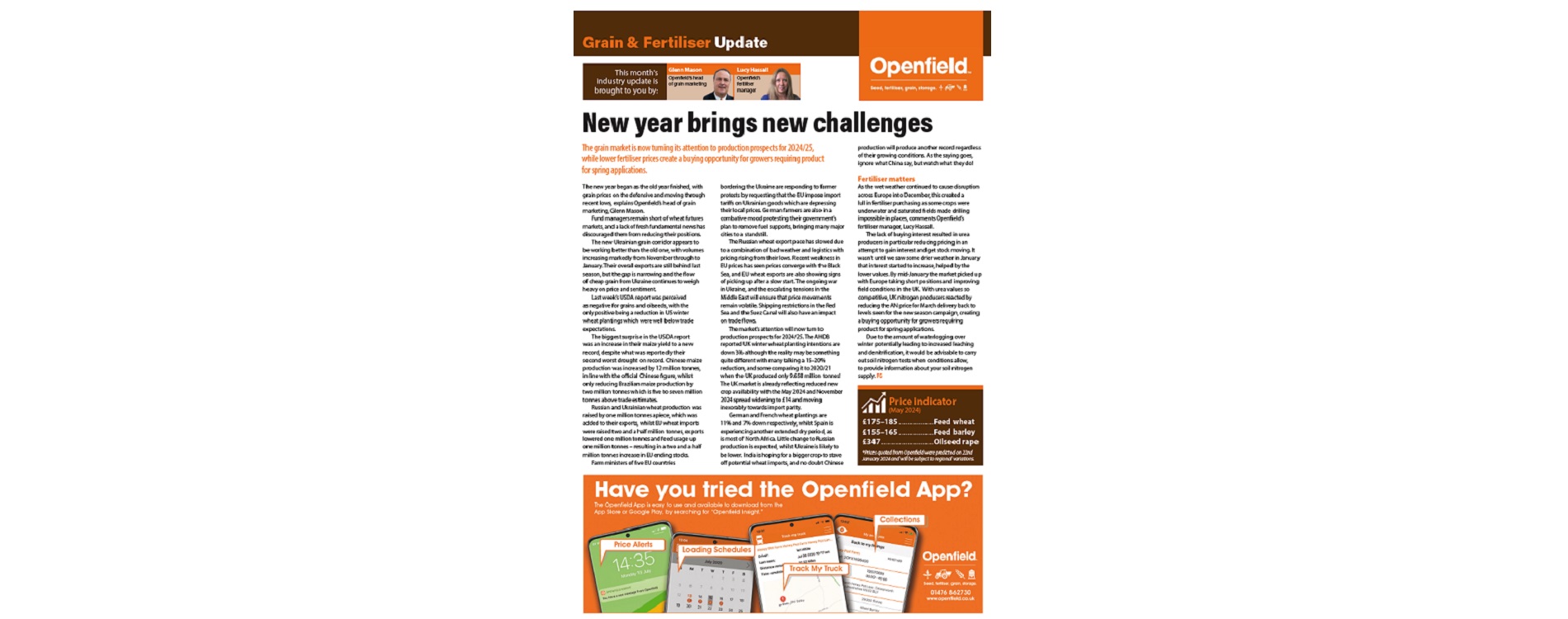

The grain market is now turning its attention to production prospects for 2024/25, while lower fertiliser prices create a buying opportunity for growers requiring product for spring applications.

The new year began as the old year finished, with grain prices on the defensive and moving through recent lows, explains Openield’s head of grain marketing, Glenn Mason. Fund managers remain short of wheat futures markets, and a lack of fresh fundamental news has discouraged them from reducing their positions. The new Ukrainian grain corridor appears to be working better than the old one, with volumes increasing markedly from November through to January. Their overall exports are still behind last season, but the gap is narrowing and the flow of cheap grain from Ukraine continues to weigh heavy on price and sentiment.

Last week’s USDA report was perceived as negative for grains and oilseeds, with the only positive being a reduction in US winter wheat plantings which were well below trade expectations.

The biggest surprise in the USDA report was an increase in their maize yield to a new record, despite what was reportedly their second worst drought on record. Chinese maize production was increased by 12 million tonnes, in line with the official Chinese figure, whilst only reducing Brazilian maize production by two million tonnes which is five to seven million tonnes above trade estimates. Russian and Ukrainian wheat production was raised by one million tonnes apiece, which was added to their exports, whilst EU wheat imports were raised two and a half million tonnes, exports lowered one million tonnes and feed usage up one million tonnes – resulting in a two and a half million tonnes increase in EU ending stocks.

Farm ministers of five EU countries bordering the Ukraine are responding to farmer protests by requesting that the EU impose import tariffs on Ukrainian goods which are depressing their local prices. German farmers are also in a combative mood protesting their government’s plan to remove fuel supports, bringing many major cities to a standstill. The Russian wheat export pace has slowed due to a combination of bad weather and logistics with pricing rising from their lows. Recent weakness in EU prices has seen prices converge with the Black Sea, and EU wheat exports are also showing signs of picking up after a slow start. The ongoing war in Ukraine, and the escalating tensions in the Middle East will ensure that price movements remain volatile. Shipping restrictions in the Red

Sea and the Suez Canal will also have an impact on trade flows. The market’s attention will now turn to production prospects for 2024/25. The AHDB reported UK winter wheat planting intentions are down 3% although the reality may be something quite different with many talking a 15–20% reduction, and some comparing it to 2020/21 when the UK produced only 9.658 million tonnes!

The UK market is already reflecting reduced new crop availability with the May 2024 and November 2024 spread widening to £14 and moving inexorably towards import parity. German and French wheat plantings are 11% and 7% down respectively, whilst Spain is experiencing another extended dry period, as is most of North Africa. Little change to Russian production is expected, whilst Ukraine is likely to be lower. India is hoping for a bigger crop to stave off potential wheat imports, and no doubt Chinese production will produce another record regardless

of their growing conditions. As the saying goes, ignore what China say, but watch what they do!

Fertiliser matters

As the wet weather continued to cause disruption across Europe into December, this created a lull in fertiliser purchasing as some crops were underwater and saturated fields made drilling impossible in places, comments Openfield’s fertiliser manager, Lucy Hassall. The lack of buying interest resulted in urea producers in particular reducing pricing in an attempt to gain interest and get stock moving. It wasn’t until we saw some drier weather in January that interest started to increase, helped by the lower values. By mid-January the market picked up with Europe taking short positions and improving field conditions in the UK. With urea values so competitive, UK nitrogen producers reacted by reducing the AN price for March delivery back to levels seen for the new season campaign, creating a buying opportunity for growers requiring product for spring applications. Due to the amount of waterlogging over winter potentially leading to increased leaching

and denitrification, it would be advisable to carry out soil nitrogen tests when conditions allow, to provide information about your soil nitrogen supply.